Earlier, these products offered limited benefits

Your lovey-dovey pet is nothing short of a family member to you. Therefore, like other members of the family you prefer to ensure their health and security. Apart from buying them expensive gifts and treating them to salon and spa treatments are now routine ways that pet parents (as they prefer to be addressed) show their love and affection for their four-legged children. But all these efforts can go in vein if you have skipped their health insurance. Recently, two companies have launched health insurance specific for dogs and cats. We can peek into their features.

Existing vs New

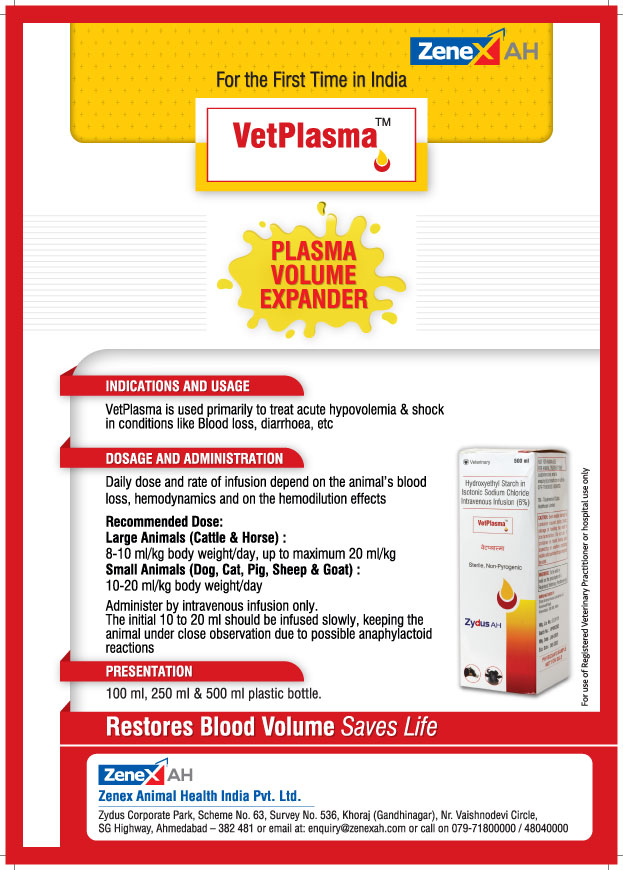

Policies those existed earlier covered only death benefits but skipped life saving treatment. However recent products have entirely changed the scenario. Pawinsure, a company that offers insurance for all breeds of dogs and cats, has launched its product a month back.

The other pet-specific insurance policy is ‘Vetina’s Pawtect’, powered by general insurance company Digit Insurance, which was launched recently.

Bajaj Allianz General Insurance, for instance, offers pet insurance under its home insurance policy, My Home All Risk Policy, and it covers only death of the pet due to accident or disease.

Product Specification

Pawinsure’s policy covers health conditions such as heart conditions, blood pressure, diabetes, soft tissue, gastro-related ailments, cancer, etc. It does not cover doctors’ consultation fees, vaccination fees and diseases that can be vaccinated, death, accidents, birth defects, pre-existing, pregnancy related, tick-related, food poisoning, object swallowing and theft.

Premiums are approximately between 5 and 20% of the sum insured. The sum insured is chosen by the pet owner.

Digit’s Vetina’s Pawtect comes under three plans, Blue Ribbon, Red Ribbon and Yellow Ribbon. Blue Ribbon has the highest premium, covering major soft tissues surgery, third party liability, major illness, and accidental injuries. It covers a variety of high cost surgical / medical treatments that the pet may undergo and offers protection from a wide range of major illnesses, major soft tissues surgeries, and major soft tissue surgeries cover, any accidental injuries and third-party liabilities.

These plans also cover specialized therapies such as stem cell therapy, laser therapy, blood transfusion and platelet rich plasma therapy under major illness section.

Benefits include consultation /examination fee, emergency care provided, surgeries carried out, laboratory tests for diagnosis, X-Rays, MRI, CT SCAN for diagnosis, hospitalisation/boarding charges, drugs and medications. It does no cover charges for regular upkeep of the pet like vaccinations, regular check-ups and grooming.

The client has the flexibility to choose from three plans and a maximum of four benefits. Service charges are based on the age of dog, breed, plan and maximum benefit selected.

The customer has the option to choose benefits up to Rs 1,50,000 depending up on the maximum benefit chosen.

To read more, subscribe to Buddy Life!

" >

" >

" >

" >