The pet population has increased in India and just like any other member of your family, pets need love and care too. Needless to say, healthcare is an important component of pet care, be it vaccination, deworming or tick treatment. And this, like everything else comes at a cost. Let’s look at cost-effective ways to cover these expenses.

By Adhil Shetty

Pet insurance

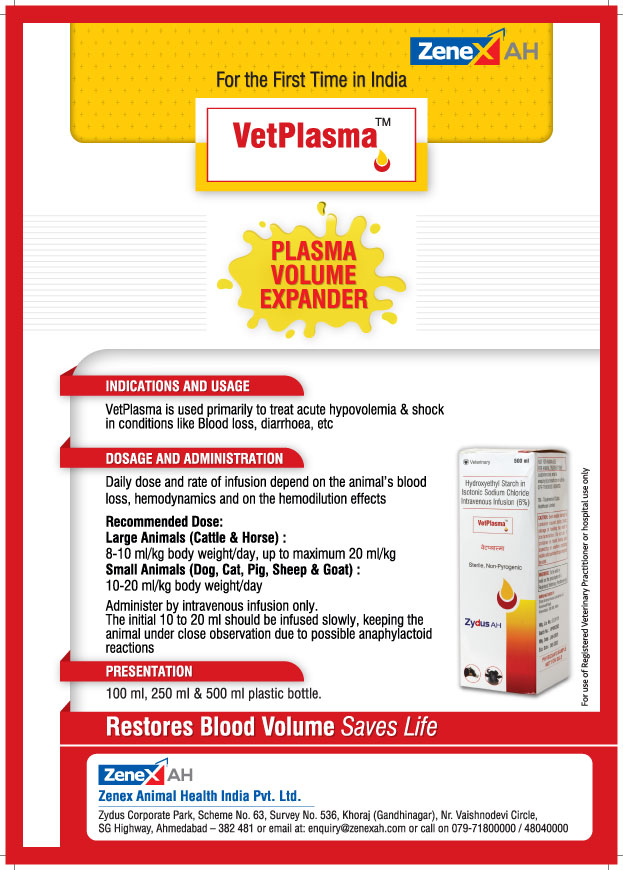

Pet insurance, like any other insurance, covers unexpected expenses related to pets. This includes veterinary bills for treatment, accidents in transit,loss or theft and death of pets.In India, cattle insurance has always been there. However, pet insurance is emerging only now. Dogs, cats, birds, sheep, goats, rabbits, horses and elephants are animals covered by this insurance. The list varies from company to company. Some companies offer insurance specifically to a particular type of pet. For instance, dog insurance covers dogs of all kinds, from exotic ones to the stray ones, from the age of eight-week old to eight-year old. It covers risks related to third-party liabilities in the event of damages caused to other people. There are also add-on benefits such as cover against lost or stolen dogs and breeding risks among others.

The process of taking insurance

Like other insurance products, there’s an age limit applicable for taking pet insurance. For example: the age bracket for buying insurance for dogs and cats is between eight weeks and eight years. For goats/sheep, it is between one and seven years.For cows, it is between two and ten years.

In order to buy pet insurance, you need to fill out the proposal form and provide a veterinary certificate for identification of the pet through tattoo, colour, sex and breed.

Ideal premium size

The sum insured in such policies is usually the replacement cost. Insurance companies typically bear 80% of the sum insured and the rest 20% is borne by the policy owners. The premium size ranges between 3% and 5% of the sum assured, but it may vary from company to company, basis the age of the pet, size of the sum assured, breed, third-party liability coverage, accidental rider, death rider, accidental-death rider, disability rider, etc.Like in case of any insurance product, one way to minimise the premium size for any insurance product is to start early, at a stage when the pre-existing diseases are low in number.

A dog insurance in the market currently covers all dogs and provides cover against major illness, accidental cover and third party cover.

Things to keep in mind

Any financial product purchase should be made after looking at a few details.First and foremost, make sure the plan is IRDA approved.Sum assured and the capping for specific risks are some other things you must keep in mind. Check if third-party liabilities risk is covered or not. Know all the ailments that are covered and the exclusions associated. Injuries/ diseases due to mal-handling/poor upkeep of pets or pre-existing illnesses are left outside the ambit of pet insurance. Also death due to rabies, Hepatitis, Enteritis, Leptospirosis are excluded from pet insurance. Moreover, make sure you read all terms and conditions, so that your claims process is carried out smoothly.

The writer is CEO, BankBazaar.

To read more, subscribe to Buddy Life!

" >

" >

" >

" >